All Blogs

19 Jan 2026

Embedded insurance — the what, why and how

E-commerce in India has matured. Customers are shopping across categories, paying digitally, and getting orders delivered to remote towns in days.

E-commerce in India has matured. Customers are shopping across categories, paying digitally, and getting orders delivered to remote towns in days.

E-commerce in India has matured. Customers are shopping across categories, paying digitally, and getting orders delivered to remote towns in days.

Shubhang Chokhani

Shubhang Chokhani

Shubhang Chokhani

Brand Strategist

Brand Strategist

Brand Strategist

Insurance

3 min read

3 min read

3 min read

Embedded insurance isn't new. Airlines have been selling travel insurance at checkout for years. Electronics retailers have offered device protection forever.

What's changed is scale. Insurance is now embedded across digital commerce, fintech, mobility, and SaaS in ways that alter how people buy coverage.

What it actually is

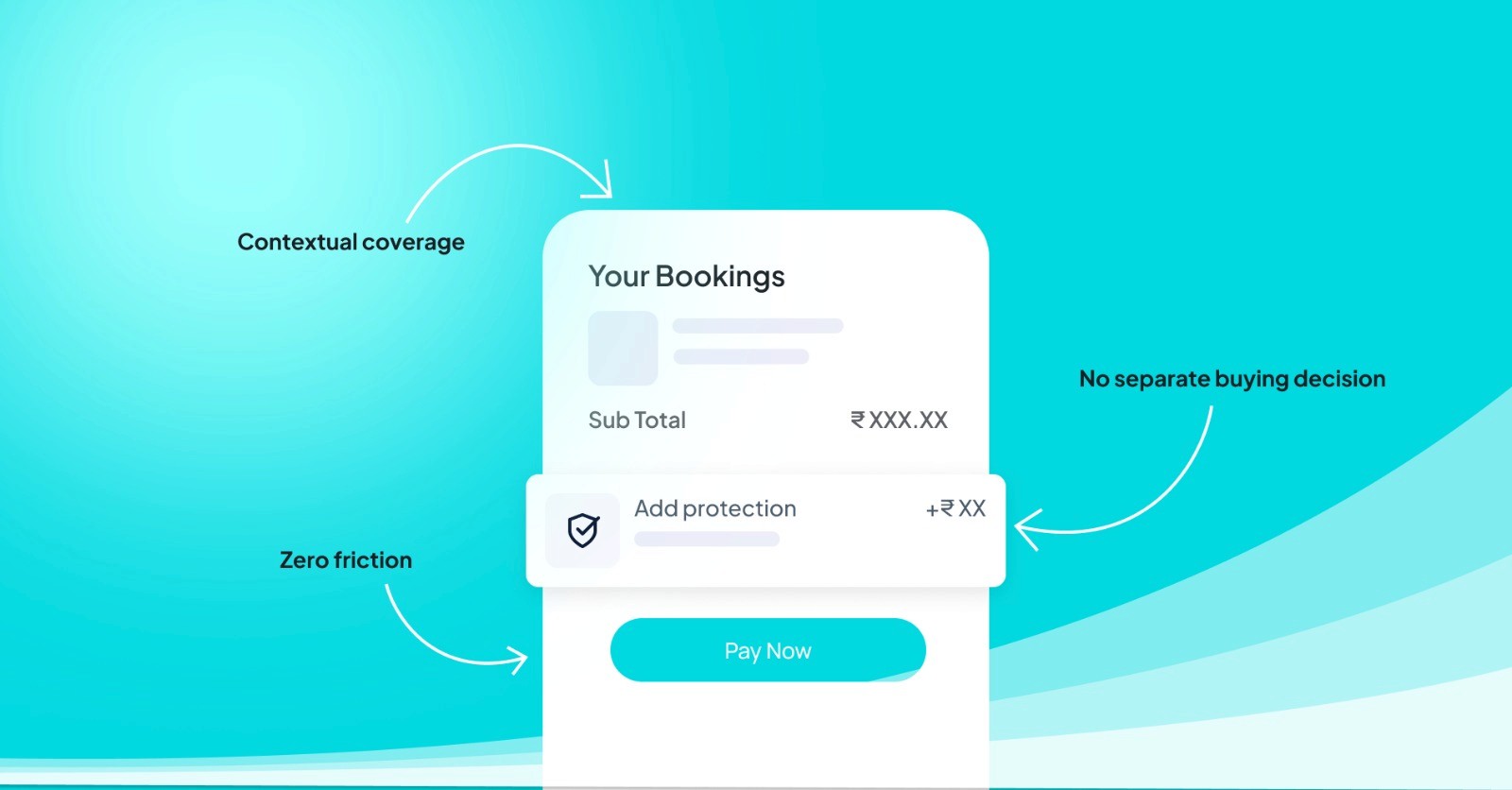

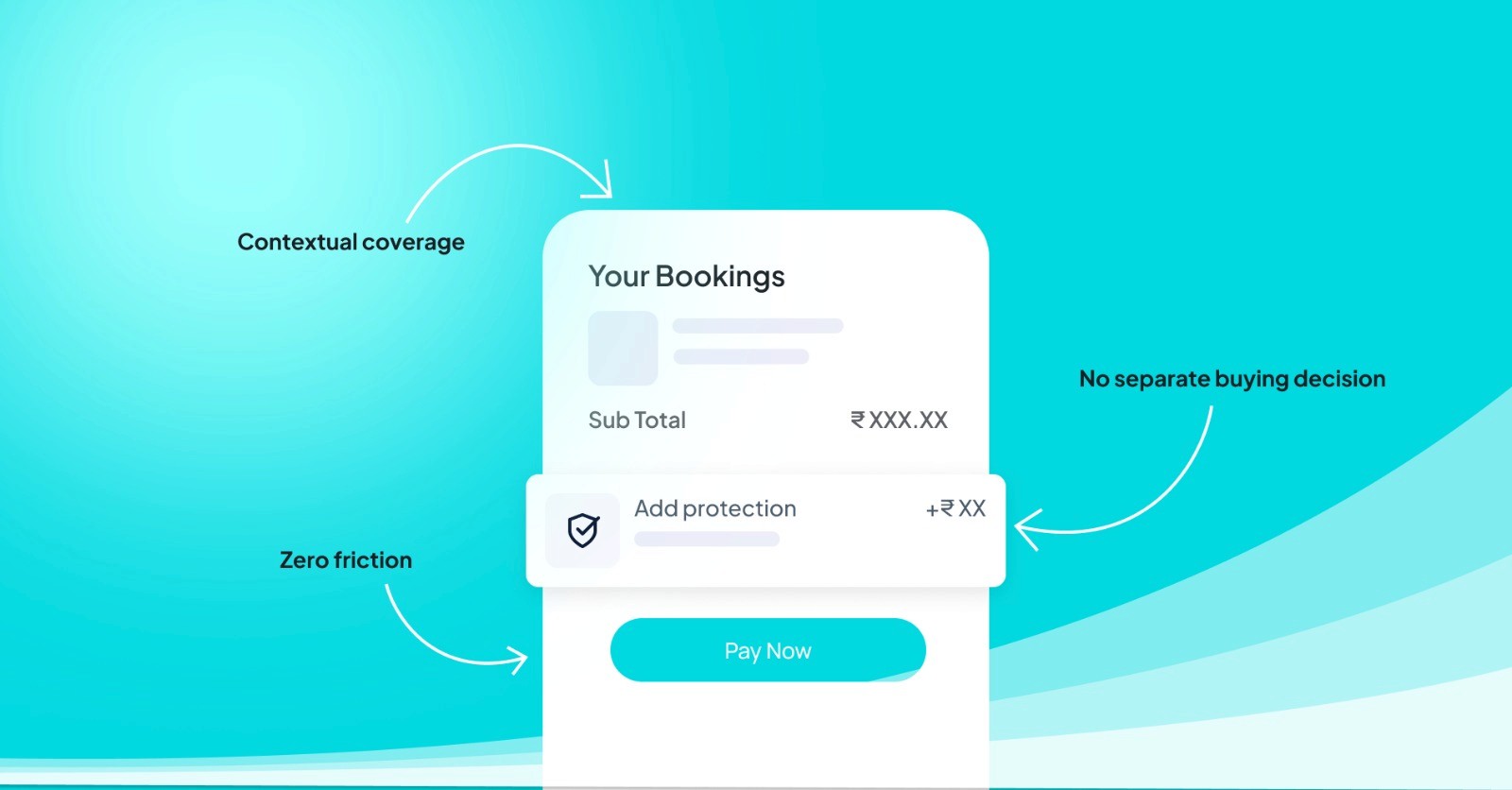

Embedded insurance is coverage offered at the point of a transaction, not as a standalone product.

Buying a phone? Protection appears as an option. Booking a flight? Cancellation cover shows up. Renting a scooter? Damage waiver is included.

The key: insurance becomes a feature of another purchase, not a separate decision requiring research.

Traditional insurance distribution:

Customer realizes they need insurance

Searches for providers

Compares policies

Completes application

Waits for approval

Receives policy

Embedded insurance: click yes at checkout.

Why it works

Timing solves the motivation problem People know they should buy insurance but delay indefinitely. Embedded insurance happens when motivation is highest: right after committing money to something valuable.

Trust transfer Traditional insurance builds credibility from scratch. Embedded insurance borrows trust from the platform. Trust Flipkart? You'll probably trust their protection offer.

Simpler underwriting Traditional insurance underwrites the person. Embedded insurance underwrites the transaction. Risk is bounded. Approval is instant.

Lower distribution cost Traditional distribution involves agents, advisors, advertising. Embedded insurance reaches customers already transacting. Customer acquisition is dramatically cheaper.

How it works

Three common models:

White-label partnership Platform partners with an insurer. Insurer provides policy and handles claims. Platform offers it under their brand.

Insurance-as-a-Service Platform uses infrastructure that handles policy administration and claims. Platform controls experience without needing insurance expertise.

Full-stack Platform builds or acquires insurance capability. Complete control, requires deep expertise.

Most platforms start with white-label, move to infrastructure partnerships as they scale.

Where it works best

High-frequency, high-risk: Electronics, mobility, travel. Damage feels realistic.

High-value, low-frequency: Appliances, luxury goods. Expensive enough that replacement hurts.

Trust-dependent transactions: P2P marketplaces, rentals. Protection reduces friction.

Digital-first experiences: SaaS, subscriptions, digital wallets. Users comfortable with digital transactions.

It struggles where risk feels abstract, purchase value is low, or customers can't visualize what would go wrong.

What good execution looks like

From a customer's perspective, embedded insurance should feel invisible until needed.

At purchase: One-click decision. Clear pricing. Simple terms.

During coverage: Easy access to policy details.

At claims: Fast filing. Quick resolution. Minimal documentation.

The difference between good and bad embedded insurance is almost entirely claims experience. Smooth claims create brand advocates. Difficult claims create brand critics.

The real opportunity

Embedded insurance is becoming infrastructure. Like payments, it's shifting from nice-to-have to competitive necessity.

The advantage isn't just incremental revenue. It's owning the customer relationship when something goes wrong. When someone's phone breaks or flight gets cancelled, whoever helps them gets remembered.

That moment creates loyalty that's hard to replicate through marketing alone.

At Assurekit, we're building infrastructure that makes this practical. Platforms can offer embedded protection without becoming insurance experts. Customers get experiences that feel native to platforms they trust.

The opportunity in embedded insurance isn't complicated. It's being there when customers actually need help.

Embedded insurance isn't new. Airlines have been selling travel insurance at checkout for years. Electronics retailers have offered device protection forever.

What's changed is scale. Insurance is now embedded across digital commerce, fintech, mobility, and SaaS in ways that alter how people buy coverage.

What it actually is

Embedded insurance is coverage offered at the point of a transaction, not as a standalone product.

Buying a phone? Protection appears as an option. Booking a flight? Cancellation cover shows up. Renting a scooter? Damage waiver is included.

The key: insurance becomes a feature of another purchase, not a separate decision requiring research.

Traditional insurance distribution:

Customer realizes they need insurance

Searches for providers

Compares policies

Completes application

Waits for approval

Receives policy

Embedded insurance: click yes at checkout.

Why it works

Timing solves the motivation problem People know they should buy insurance but delay indefinitely. Embedded insurance happens when motivation is highest: right after committing money to something valuable.

Trust transfer Traditional insurance builds credibility from scratch. Embedded insurance borrows trust from the platform. Trust Flipkart? You'll probably trust their protection offer.

Simpler underwriting Traditional insurance underwrites the person. Embedded insurance underwrites the transaction. Risk is bounded. Approval is instant.

Lower distribution cost Traditional distribution involves agents, advisors, advertising. Embedded insurance reaches customers already transacting. Customer acquisition is dramatically cheaper.

How it works

Three common models:

White-label partnership Platform partners with an insurer. Insurer provides policy and handles claims. Platform offers it under their brand.

Insurance-as-a-Service Platform uses infrastructure that handles policy administration and claims. Platform controls experience without needing insurance expertise.

Full-stack Platform builds or acquires insurance capability. Complete control, requires deep expertise.

Most platforms start with white-label, move to infrastructure partnerships as they scale.

Where it works best

High-frequency, high-risk: Electronics, mobility, travel. Damage feels realistic.

High-value, low-frequency: Appliances, luxury goods. Expensive enough that replacement hurts.

Trust-dependent transactions: P2P marketplaces, rentals. Protection reduces friction.

Digital-first experiences: SaaS, subscriptions, digital wallets. Users comfortable with digital transactions.

It struggles where risk feels abstract, purchase value is low, or customers can't visualize what would go wrong.

What good execution looks like

From a customer's perspective, embedded insurance should feel invisible until needed.

At purchase: One-click decision. Clear pricing. Simple terms.

During coverage: Easy access to policy details.

At claims: Fast filing. Quick resolution. Minimal documentation.

The difference between good and bad embedded insurance is almost entirely claims experience. Smooth claims create brand advocates. Difficult claims create brand critics.

The real opportunity

Embedded insurance is becoming infrastructure. Like payments, it's shifting from nice-to-have to competitive necessity.

The advantage isn't just incremental revenue. It's owning the customer relationship when something goes wrong. When someone's phone breaks or flight gets cancelled, whoever helps them gets remembered.

That moment creates loyalty that's hard to replicate through marketing alone.

At Assurekit, we're building infrastructure that makes this practical. Platforms can offer embedded protection without becoming insurance experts. Customers get experiences that feel native to platforms they trust.

The opportunity in embedded insurance isn't complicated. It's being there when customers actually need help.

Ready to level up?

Ready to level up?

Ready to level up?

Assurekit is a full-stack digital insurance platform built for growth, that enables anyone to create, sell and manage contextual insurance products in a plug-and-play manner

©2024 Assurekit technology & service pvt ltd

Assurekit is a full-stack digital insurance platform built for growth, that enables anyone to create, sell and manage contextual insurance products in a plug-and-play manner

©2024 Assurekit technology & service pvt ltd

Assurekit is a full-stack digital insurance platform built for growth, that enables anyone to create, sell and manage contextual insurance products in a plug-and-play manner

©2024 Assurekit technology & service pvt ltd